We will be looking at doing business from a small business perspective. It is relatively easy to start a business in Australia as compared to India. Let’s look at some of the main points involved.

Structure/Setup

Some of the popular ways to setup/start a business in Australia are…

- Public Company : Complicated setup and compliance, usually for Medium and Large businesses.

- Proprietary Company : The most popular structure for a small business, having the benefits limited liability and professional appearance.

- Trusts : Another very popular option for small businesses. If coupled with a corporate trustee it can provide both limited liability and income distribution to minimize tax liability.

- Partnerships : Easy setup, liability not limited (alternate is corporate limited partnership) and partners may be severally and jointly liable.

- Sole Proprietor : Easiest setup with the lowest cost, No limited liability, but very good for micro business, especially which involve personal Services Income e.g.: Taxi, Security Guard etc.,

- Branch of Foreign Entity : A foreign entity can opt to open a branch and operate in Australia (subject to company tax rate on profits – no additional branch office tax or such) – This would most likely be considered as a permanent establishment under the DTAA agreement between India and Australia.

Tax Implications

There are a myriad types of Taxes to consider, we will be looking broadly at the federal taxes, States have their own regime including stamp-duty etc.,

The main federal taxes are …

- Income Tax: This is tax on net income/profits.

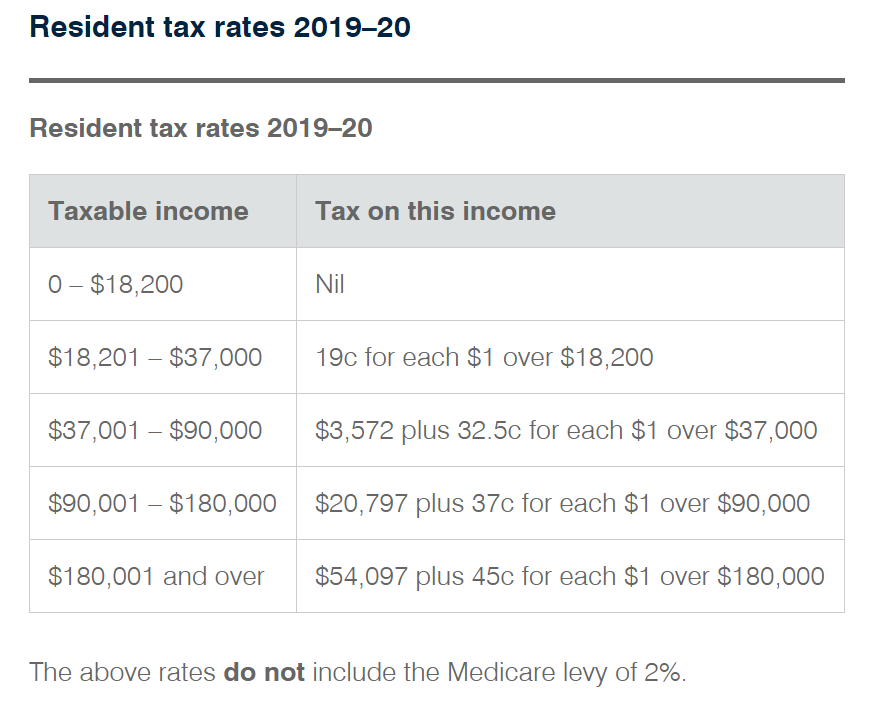

- rates for 2020 Financial year (Resident Individuals)

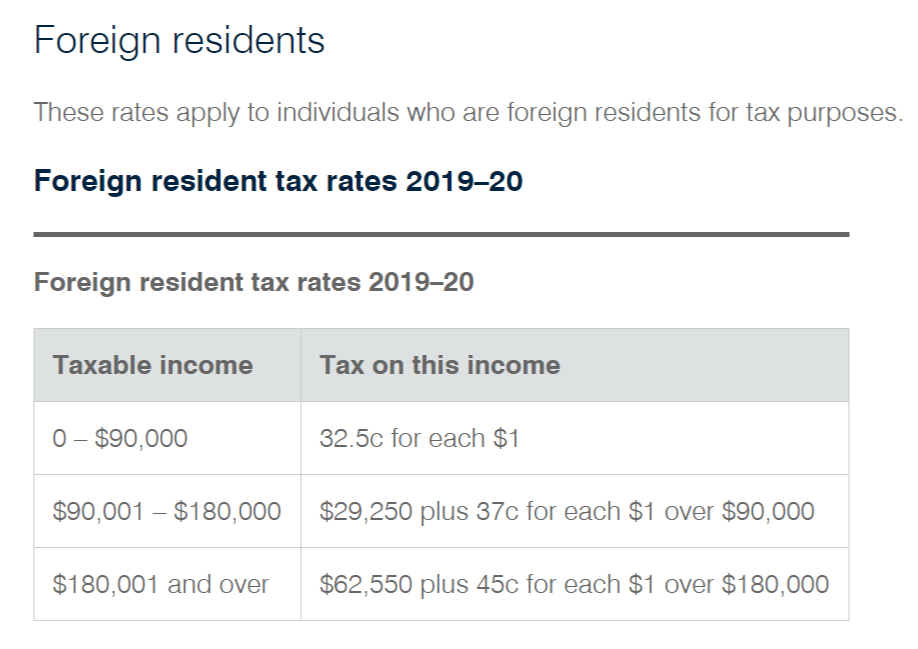

- rates for 2020 Financial year (Non resident Individuals)

- Corporate tax rate is 30% ( Base rate entities – below specified threshold currently 27.5%)

- Holiday working visa, Children have a different rate than Individuals above.

- Goods and Services Tax (GST) : Flat rate of 10% on eligible goods/services.

- Capital Gains : these are taxed at normal rates (individual/corporate) depending on the entity, after capital gain is computed using the approved methods (excluding discounts/exemptions), the amount is added to entities gross income and taxed at the marginal tax (tax rate of the slab the income falls under.

- Other employment based tax like Fringe Benefit (FBT) : Basically a tax on the benefits provided to employees in forms other than money e.g. Vehicle use, discounted loans etc.,

Employee Engagement Considerations

Australia has a very formal employee ecosystem, It takes a fair bit of time to get to know the intricacies. Since 1st of July 2019 , the new Single Touch Payroll (STP) regime is applicable to almost every employer.

You can go through this article Employee Considerations to get more details on STP or contact us for information specific to your situation.

Compliance Considerations

Australian tax system is largely self assessment based. This means that the entity will prepare and lodge the relevant tax returns and then Australian Taxation Office (ATO) will review and issue a Notice of Assessment. In case of any suspicion ATO may conduct an audit to verify the numbers.

Lodgement Due date are very important and expected to be followed strictly, the ATO is very strict with penalties , e.g. late lodgement of an Individual tax return may result in a penalty of $850/-; Interest on amounts due is also levied and can be very high ( e.g. 11%)

Increasingly the ATO is relying on data matching between various departments ( Immigration, Centerlink etc.,) to locate tax avoidance and conduct audits. ATO has also setup a special cell to trace tax havens overseas and this task force has been able to recover Millions. ATO can access all bank accounts of an entity, by requesting the bank for the information. Also, the new STP reporting will ensure ATO has a solid and reliable database to check super and payg payments.

Some of the enforcement options that the ATO can use are…

- Issue of Garnishee Notice to Banks/Third parties to withhold amounts.

- ATO may take legal action for recovery or liquidation of an entity.

Double Taxation Avoidance Agreement (DTAA) with India

In order to avoid double taxation i.e same Income being taxed twice , both countries have entered into an Agreement, which basically ensures that if your income will not be taxed a second time , you will get credit for the payment made previously. This results in paying tax at the lowest applicable rate, and ensures you don’t pay twice.

This agreement also has provision’s in place to share information and prevent tax avoidance.

A copy of the agreement can be found here, DTAA AGREEMENT.